UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. _____)

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ |

|

[ ] Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)). | |

[ | |

[ ] Definitive additional materials. | |

[ ] Soliciting material pursuant to §240.14a-12 | |

CONTANGO ORE, INC.

(Exact Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (check the appropriate box):

[x] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) | Title of each class of securities to which transaction applies: |

(2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, schedule or registration statement no.: |

| (3) | Filing party: |

| (4) | Date filed: |

CONTANGO ORE, INC.

3700 Buffalo Speedway, Suite 925

Houston, Texas 77098

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

,DECEMBER 11, 2020

Dear Stockholder:

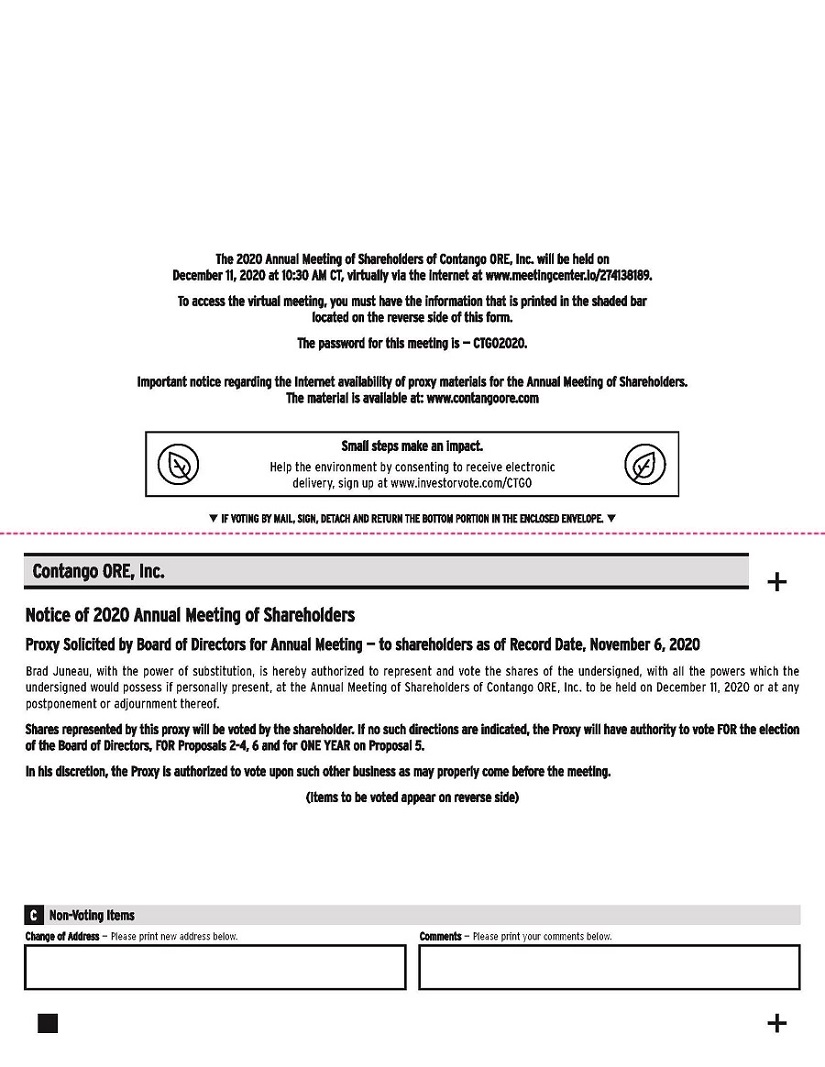

You are cordially invited to attend the 2020 Annual Meeting of Stockholders of Contango ORE, Inc., which will be held virtually on ,Friday, December 11, 2020 at 10:30 a.m., Central Time.

Important Notice Regarding the Availability of Proxy Materials

For the Annual Meeting of Stockholders to be held on ,December 11, 2020

Via Live Webcast at http://www.meetingcenter.io/274138189 (Password: CTGO2020)

In accordance with rules issued by the Securities and Exchange Commission, you may access the Notice of Annual Meeting of Stockholders, our 2020 Proxy Statement and our Annual Report at http://www.contangoore.com

At the Annual Meeting you will be asked to vote on the following matters:

(1) | To elect our Board of Directors to serve until the annual meeting of stockholders in 2021; |

(2) | To ratify the appointment of Moss Adams LLP as the independent auditors of the Company for the fiscal year ending June 30, 2021; |

| (3) | To approve an amendment to the Company’s Certificate of Incorporation that will increase the number of authorized shares of its common stock from 30,000,000 shares to 45,000,000 shares; | |

(4) | To conduct a non-binding, advisory vote to approve the compensation of the Company’s named executive officers; | |

| (5) | To conduct a non-binding, advisory vote on the frequency of the advisory vote on the compensation of the Company’s named executive officers; | |

| (6) | To approve the grant of discretionary authority to the chairman of the Annual Meeting to adjourn the Annual Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the Annual Meeting to approve any of Proposals 1-5; and | |

| (7) | To conduct any other business that is properly raised at the Annual Meeting or any adjournment thereof. |

In light of the novel coronavirus (or COVID-19) outbreak, and for the health and well-being of our stockholders, employees and directors, this year’s Annual Meeting will be conducted as a virtual meeting of stockholders, which will be held exclusively online via the Internet as a virtual web conference.

Stockholders who owned shares of Contango ORE, Inc.’s common stock, par value $0.01 per share, at the close of business on ,November 6, 2020 are entitled to receive notice of and to attend and vote at the Annual Meeting via live webcast online at http://www.meetingcenter.io/274138189 (Password: CTGO2020). Stockholders will need their 15-digit control number provided on their proxy card or voting instructions form to vote while attending the meeting online. Stockholders who attend the virtual meeting with their 15-digit control number will have the same rights and opportunities to participate as they would at an in-person meeting. If your voting instruction form does not include a 15-digit control number, you must contact your brokerage firm, bank, or other financial institution for instructions to access the Annual Meeting. If you do not have your 15-digit control number, you will still be able to attend the Annual Meeting as a “guest” and listen to the proceedings, but you will not be able to vote or otherwise.

As a stockholder of Contango ORE, Inc., you have the right to vote on the proposals listed above. Please read the Proxy Statement carefully because it contains important information for you to consider when deciding how to vote. Your vote is important.

You have three options in submitting your vote prior to the Annual Meeting date:

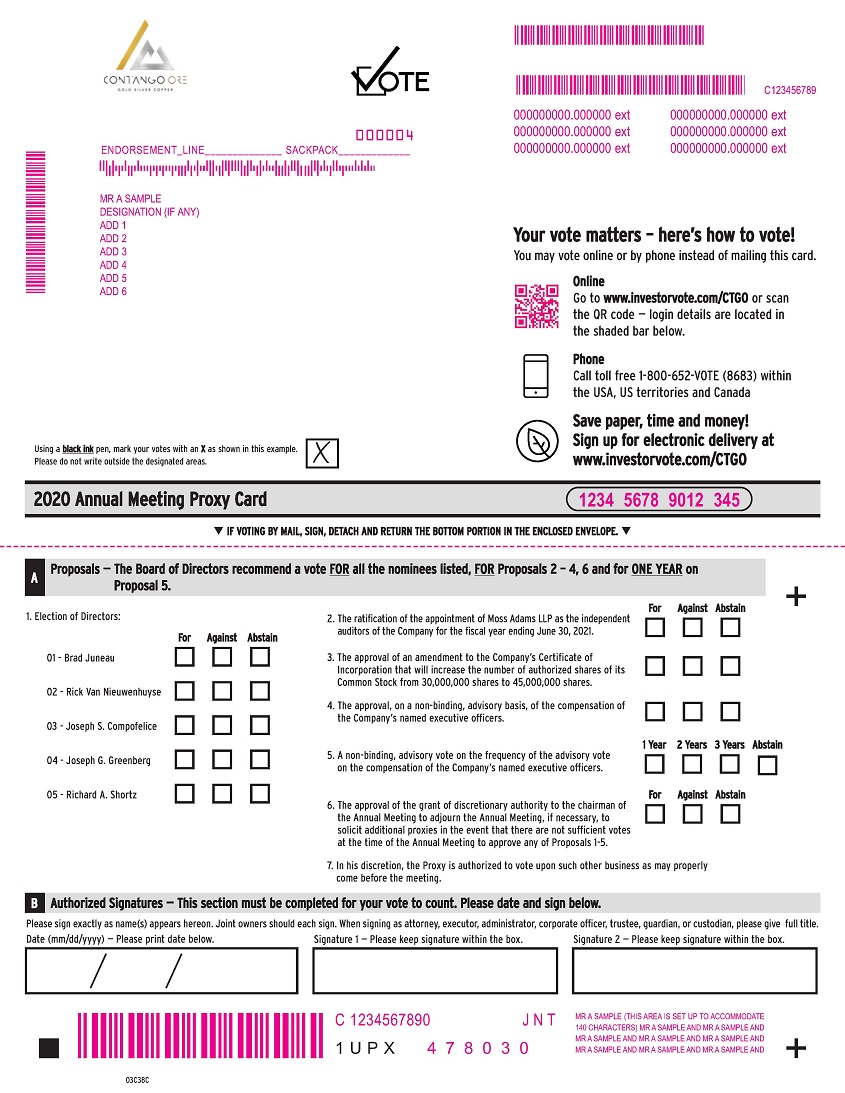

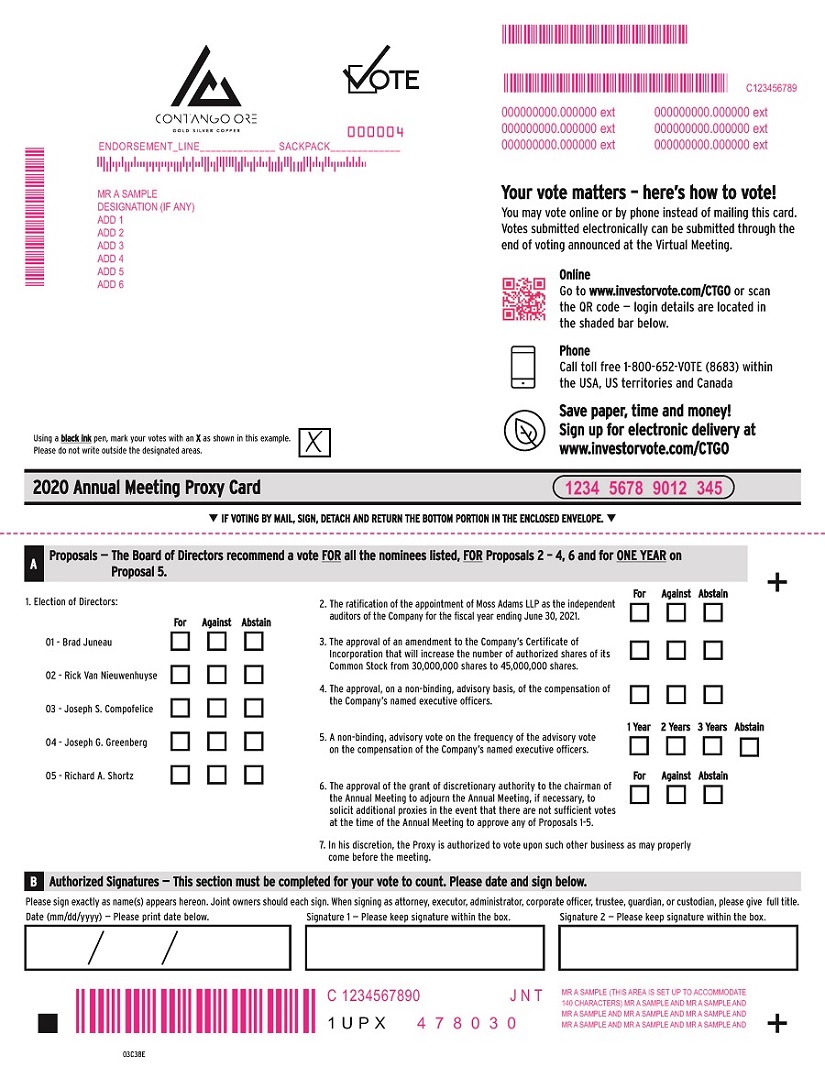

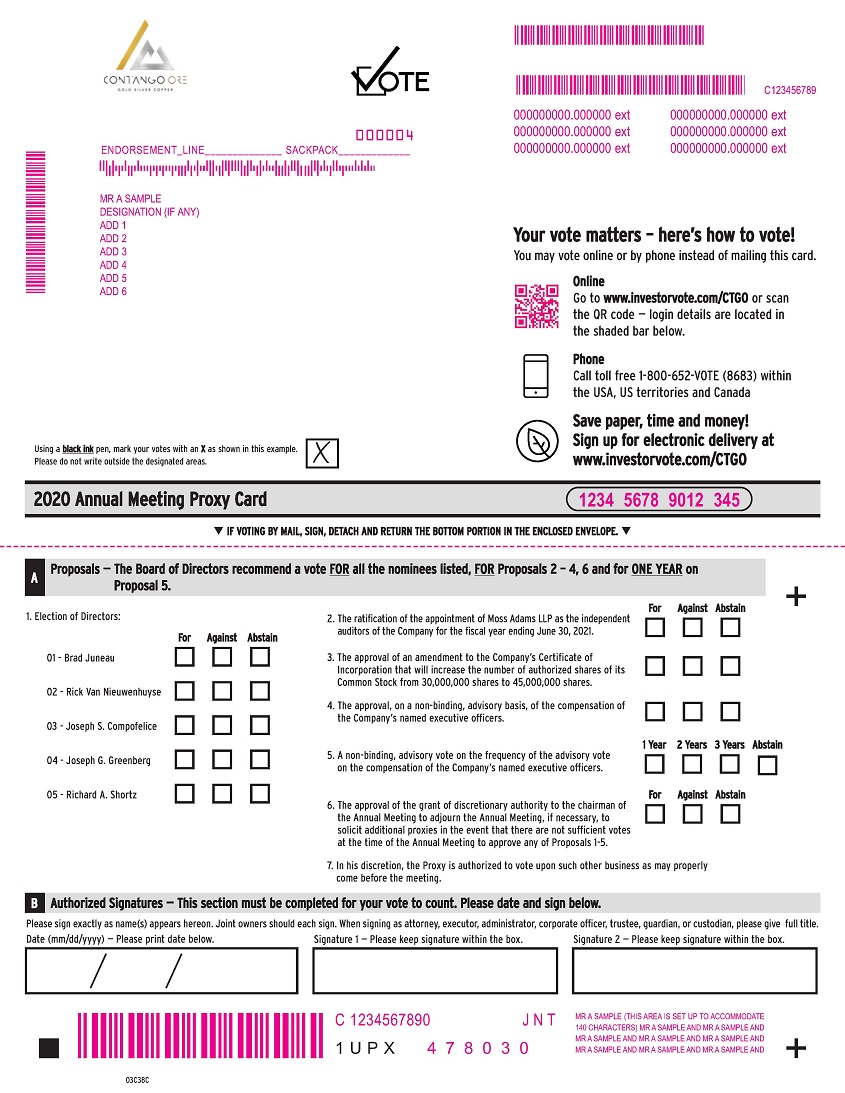

(1) You may sign and return the enclosed proxy card in the accompanying envelope;

(2) You may vote over the Internet at the address shown on your proxy card; or

(3) You may vote by telephone using the phone number shown on your proxy card.

Whether or not you plan to attend the Annual Meeting virtually, please date, sign and return the enclosed proxy card promptly or vote over the telephone or Internet. A postage-paid return envelope is enclosed for your convenience. If you decide to attend the Annual Meeting, you can revoke your proxy and vote virtually. If you have any questions, please contact us through our website at www.contangoore.com, call us at (713) 877-1311, or write us at 3700 Buffalo Speedway, Suite 925, Houston, Texas 77098.

By order of the Board of Directors,

/s/ Brad Juneau

Brad Juneau

Executive Chairman and Director

Houston, Texas ,November 9, 2020

CONTANGO ORE, INC.

3700 Buffalo Speedway, Suite 925

Houston, Texas 77098

_____________________

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

,December 11, 2020

_________________________________________

To our Stockholders:

The Board of Directors (the “Board”) of Contango ORE, Inc., a Delaware corporation (the “Company” or “CORE”), is furnishing you with this Proxy Statement in connection with its solicitation of your proxy, in the form enclosed, for use at the 2020 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Friday, December 11, 2020 at 10:30 a.m., Central Time, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders.

In light of the novel coronavirus (or COVID-19) outbreak, and for the health and well-being of our stockholders, employees and directors, this year’s Annual Meeting will be conducted as a virtual meeting of stockholders, which will be held exclusively online via the Internet as a virtual web conference. You will be able to attend the Annual Meeting online, vote your shares online during the Annual Meeting and submit your questions online during the Annual Meeting by visiting http://viewproxy.com/Contango/2020/vm. There will not be a physical meeting location, and you will not be able to attend the Annual Meeting in person. We intend to return to an in-person annual meeting format in 2021.

Important Notice Regarding the Availability of Proxy Materials

For the Annual Meeting of Stockholders to be held on ,December 11, 2020

Via Live Webcast at http://www.meetingcenter.io/274138189 (Password: CTGO2020)

In accordance with rules issued by the Securities and Exchange Commission, you may access the Notice of Annual Meeting of Stockholders, our 2020 Proxy Statement and our Annual Report at http://www.contangoore.com

At the Annual Meeting you will be asked to vote on the following matters:

(1) | To elect members of our Board of Directors to serve until the annual meeting of stockholders in 2021; |

(2) | To ratify the appointment of Moss Adams LLP as the independent auditors of the Company for the fiscal year ending June 30, 2021; |

| (3) | To approve an amendment to the Company’s Certificate of Incorporation that will increase the number of authorized shares of its common stock from 30,000,000 shares to 45,000,000 shares; | |

| (4) | To conduct a non-binding advisory vote to approve the compensation of the Company’s named executive officers; | |

| (5) | To conduct a non-binding, advisory vote on the frequency of the advisory vote on the compensation of the Company’s named executive officers; | |

| (6) | To approve the grant of discretionary authority to the chairman of the Annual Meeting to adjourn the Annual Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the Annual Meeting to approve any of Proposals 1-5; and | |

(7) | To conduct any other business that is properly raised at the Annual Meeting or any adjournment thereof. |

Stockholders who owned shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), at the close of business on ,November 6, 2020 are entitled to receive notice of and to attend and vote at the Annual Meeting via live webcast online at http://www.meetingcenter.io/274138189 (Password: CTGO2020). Stockholders will need their 15-digit control number provided on their proxy card or voting instructions form to vote while attending the meeting online. Stockholders who attend the virtual meeting with their 15-digit control number will have the same rights and opportunities to participate as they would at an in-person meeting. If your voting instruction form does not include a 15-digit control number, you must contact your brokerage firm, bank, or other financial institution for instructions to access the Annual Meeting. If you do not have your 15-digit control number, you will still be able to attend the Annual Meeting as a “guest” and listen to the proceedings, but you will not be able to vote or otherwise.

As a stockholder of the Company, you have the right to vote on the proposals listed above. Please read the Proxy Statement carefully because it contains important information for you to consider when deciding how to vote. Your vote is important.

You have three options in submitting your vote prior to the Annual Meeting date:

(1) You may sign and return the enclosed proxy card in the accompanying envelope;

(2) You may vote over the Internet at the address shown on your proxy card; or

(3) You may vote by telephone using the phone number shown on your proxy card.

We are distributing this Proxy Statement to you on or about ,November 11, 2020, together with the accompanying proxy card and the Company’s annual report on Form 10-K for the fiscal year ended June 30, 2020, as filed with the SEC on September 25, 2020 (the “Annual Report”).

We cordially invite you to attend the Annual Meeting. Whether or not you plan to attend, please complete, date and sign the proxy card and return it promptly in the return envelope provided, or you may vote over the telephone or Internet by following the instructions on the proxy card or other enclosed proxy material.

The Annual Meeting.

| 1. | Q: | Who is asking for my proxy? |

A: | Your proxy is being solicited by our Board for use at our Annual Meeting. Our directors, officers or executives may also solicit proxies on behalf of our Board, in person or by telephone, facsimile, mail or e-mail. If our directors, officers or executives solicit proxies, they will not be specially compensated. The Company will pay all costs and expenses of this proxy solicitation. | |

| 2. | Q. | What are stockholders being asked to vote on? |

A: | At our Annual Meeting, stockholders will be asked to vote: |

to elect the members of our Board to serve until the annual meeting of stockholders in 2021;

to ratify the appointment of Moss Adams LLP as the independent auditors of the Company for the fiscal year ending June 30, 2021;

| • | to approve an amendment to the Company’s Certificate of Incorporation that will increase the number of authorized shares of its Common Stock from 30,000,000 shares to 45,000,000 shares; | |

• | to approve, on a non-binding, advisory basis, the compensation of the Company’s named executive officers; |

| • | to conduct a non-binding, advisory vote on the frequency of the advisory vote on the compensation of the Company’s named executive officers; | |

| • | to approve the grant of discretionary authority to the chairman of the Annual Meeting to adjourn the Annual Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the Annual Meeting to approve any of Proposals 1-5; and | |

• | on any other matter that may properly come before the Annual Meeting or any adjournment of the Annual Meeting. |

| 3. | Q. | Who is entitled to vote? |

A: | Holders of record of issued and outstanding shares of Common Stock, par value $0.01 per share, of the Company (the “Common Stock”), who owned such shares at the close of business on | |

| 4. | Q: | How many shares may vote at the Annual Meeting? |

A: | Each record holder of Common Stock is entitled to one vote per share of Common Stock owned on the Record Date. | |

| 5. | Q: | How do I vote my shares? |

A: | A proxy card is included with the proxy materials being sent to you. The proxy card allows you to specify how you want your shares voted as to each proposal listed. The proxy card provides space for you to: |

▪ | Vote for, or withhold authority to vote for, each nominee for director; |

▪ | Vote for or against, or abstain from voting on, the ratification of the appointment of Moss Adams LLP as independent public accountants for the fiscal year ending June 30, 2021 |

| ▪ | Vote for or against, or abstain from voting on, the approval of an amendment to the Company’s Certificate of Incorporation that will increase the number of authorized shares of its Common Stock from 30,000,000 shares to 45,000,000 shares; | |

| ▪ | Vote for or against, or abstain from voting on, the approval, on a non-binding advisory basis, of the compensation of our named executive officers; | |

| ▪ | Vote “one year”, “two years”, “three years” or abstain from voting on the advisory vote on the frequency of the advisory vote on the compensation of the Company’s named executive officers; and | |

| ▪ | Vote for or against, or abstain from voting on, the grant of discretionary authority to the chairman of the Annual Meeting to adjourn the Annual Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the Annual Meeting to approve any of Proposals 1-5. | |

If the proxy card is properly signed and returned to us, shares covered by the proxy card will be voted in accordance with the directions you specify on the card. The person named as proxy on the proxy card is Brad Juneau, the Company’s Executive Chairman and Director. Any stockholder who wishes to name a different person as his or her proxy may do so by crossing out Mr. Juneau’s name and inserting the name of another person to act as his or her proxy. In such a case, the stockholder would be required to sign the proxy card and deliver it to the person named as his or her proxy, and that person would be required to be present and vote at the Annual Meeting. Any proxy card so marked should not be mailed to the Company.

If you return a signed proxy card without having specified any choices, Mr. Juneau, named as proxy, will vote the shares represented at the Annual Meeting and any adjournment thereof as follows:

▪ | FOR the election of each nominee for director; |

▪ | FOR the ratification of the appointment of Moss Adams LLP as independent public accountants for the fiscal year ending June 30, 2021; |

| ▪ | FOR the approval of the amendment to our Certificate of Incorporation to increase the number of authorized shares of our Common Stock from 30,000,000 shares to 45,000,000 shares; | |

▪ | FOR the approval, on a non-binding, advisory basis, of the compensation of our named executive officers; |

| ▪ | ONE YEAR on the advisory vote on the frequency of the advisory vote on the compensation of our named executive officers; | |

| ▪ | FOR the grant of discretionary authority to the chairman of the Annual Meeting to adjourn the Annual Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the Annual Meeting to approve any of Proposals 1-5; and | |

▪ | At the discretion of Mr. Juneau, as proxy, on any other matter that may properly come before the Annual Meeting or any adjournment of the Annual Meeting. |

| 6. | Q: | How does the Board recommend I vote? |

A: | The Board unanimously recommends that you vote: |

▪ | FOR the election of each nominee for director; |

▪ | FOR the ratification of the appointment of Moss Adams LLP as independent public accountants for the fiscal year ending June 30, 2021; |

| ▪ | FOR the approval of the amendment to our Certificate of Incorporation to increase the number of authorized shares of our Common Stock from 30,000,000 shares to 45,000,000 shares; | |

▪ | FOR the approval, on a non-binding, advisory basis, of the compensation of our named executive | |

| ONE YEAR on the advisory vote on the frequency of the advisory vote on the compensation of our named executive officers; and | ||

| ▪ | FOR the grant of discretionary authority to the chairman of the Annual Meeting to adjourn the Annual Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the Annual Meeting to approve any of Proposals 1-5. |

Our executive officers and directors who own shares of Common Stock have advised us that they intend to vote their shares in favor of the proposals presented in this Proxy Statement. As of the close of business on the Record Date, [5,994,667]5,994,667 shares of Common Stock were issued and outstanding, approximately 22.2% of which were owned and entitled to be voted by CORE’s executive officers and directors.

| 7. | Q: | What vote is required? |

A: | Election of directors requires the affirmative vote of a plurality of the votes cast at the Annual Meeting. Additionally, a plurality of the votes cast will be considered the stockholders’ preferred frequency for holding an advisory vote on the compensation of our named executive officers.All other proposals require the affirmative vote of a majority of the shares present in person or represented by proxy entitled to vote thereon. |

| 8. | Q: | What is a “quorum”? |

A: | Presence at the Annual Meeting, in person or by proxy, of holders of a majority of the votes entitled to be cast by all record holders of Common Stock will constitute a quorum for the transaction of business. If a quorum is not present, the Annual Meeting may be adjourned from time to time until a quorum is obtained. |

| 9. | Q: | What is the effect of an abstention or a broker non-vote? |

A: | Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business. A broker non-vote occurs when a nominee holding shares of Common Stock for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. Abstentions and broker non-votes will not be considered as votes cast “for” or “against” any proposal or director candidate and will not affect the outcome of the election of directors. Abstentions are counted in tabulations of the votes cast on proposals presented to stockholders as a vote against any matter other than the election of directors and advisory vote on the frequency of the advisory vote on the compensation of our named executive officers, whereas broker non-votes are not counted for purposes of determining whether a proposal has been approved. |

| 10. | Q: | What does it mean if I receive more than one proxy card? |

A: | If your shares are registered differently or in more than one account, you will receive more than one proxy card. Sign and return all proxy cards to ensure that all your shares are voted. |

| 11. | Q: | Can I revoke my proxy? |

A: | You may revoke your proxy at any time before it is exercised at the Annual Meeting by filing with or transmitting to our corporate secretary either a notice of revocation or a properly created proxy bearing a later date. You also may attend the Annual Meeting and revoke your proxy by voting your shares at the virtual Annual Meeting. |

| 12. | Q: | How will the Company solicit proxies? |

A: | Proxies may be solicited in person, by telephone, facsimile, mail or e-mail by directors, officers and executives of the Company without additional compensation. The Company will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy materials to stockholders. |

| 13. | Q: | How can a stockholder communicate with the Company’s directors? |

A: | The Board has established a process to receive communications from interested parties, including stockholders. Interested parties may contact any member (or all members) of the Board or the independent directors as a group, any committee of our Board or any chair of any such committee by mail to c/o Corporate Secretary, Contango ORE, Inc., 3700 Buffalo Speedway, Suite 925, Houston, Texas 77098, or by e-mail to info@contangoore.com. Correspondence may be addressed to any individual director by name, to the independent directors as a group or to any chair of any committee either by name or title. Mail will not be opened but will be forwarded to the Chairman of the Audit Committee or the named independent director. |

PROPOSAL 1

ELECTION OF DIRECTORS

At the Annual Meeting, we will present the nominees named below and recommend that they be elected to serve as directors until the next annual stockholders meeting or until their successors are duly elected and qualified. Each nominee has consented to being named in this Proxy Statement and to serve if elected.

Your proxy will be voted for the election of the four nominees named below unless you give instructions to the contrary. Your proxy cannot be voted for a greater number of persons than the number of nominees named.

Nominees

Presented below is a description of certain biographical information, occupations and business experience for the past five years of each person nominated to become a director. Five directors are to be elected at the Annual Meeting. All nominees are current directors standing for reelection to the Board. If any nominee should become unavailable for election, your proxy may be voted for a substitute nominee selected by the Board, or the Board’s size may be reduced accordingly. The Board is unaware of any circumstances likely to render any nominee unavailable. Directors of the Company hold office until the next annual stockholders meeting, until successors are elected and qualified or until their earlier resignation or removal. Each nominee other than Mr. Van Nieuwenhuyse and Mr. Juneau is an independent director.

On September 15, 2010, the Company’s Board established a Nominating Committee to recommend nominees for director to the Board and to insure that such nominees possess the director qualifications set forth in the Company’s Corporate Governance Guidelines. Additionally, the Nominating Committee reviews the qualifications of existing Board members before they are nominated for re-election to the Board. Once nominees are selected, the Board determines which nominees are presented to the Company’s stockholders for final approval.

The Board will also consider nominees recommended by stockholders. The Company’s Bylaws contain provisions that address the process by which a stockholder may nominate an individual to stand for election to the Board at our Annual Meeting of Stockholders. The procedures include a requirement that notices regarding a person’s nomination be received in writing from the stockholder and by the Company’s Secretary not less than 60 days nor more than 90 days prior to the first anniversary of the preceding year’s annual meeting. Moreover, the notice must include such nominee’s written consent to be named in the Company’s Proxy Statement and to serve if elected. Supporting information should include (a) the name and address of the candidate and the proposing stockholder, (b) a comprehensive biography of the candidate and an explanation of why the candidate is qualified to serve as a director taking into account the criteria identified in our Corporate Governance Guidelines and (c) proof of ownership, the class and number of shares, and the length of time that the shares of our common stock have been beneficially owned by each of the candidate and the proposing stockholder. Minimum qualifications include extensive business experience, a solid understanding of financial statements and a reputation for integrity. Each nominee below has been recommended by the Nominating Committee.

Name | Age | Position | Director Since | |||

| Brad Juneau | 60 | Executive Chairman and Director | 2012 | |||

| Rick Van Nieuwenhuyse | 64 | President, Chief Executive Officer, and Director | 2020 | |||

Joseph S. Compofelice | 71 | Director | 2010 | |||

Joseph G. Greenberg | 59 | Director | 2010 | |||

Richard A. Shortz | 75 | Director | 2016 |

Brad Juneau. Mr. Juneau is co-founder of the Company and served as President, Chief Executive Officer and a director of the Company from August 2012 after the Company’s co-founder, Mr. Kenneth R. Peak, received a medical leave of absence, until January 5, 2020 when he was succeeded by Mr. Van Nieuwenhuyse. Mr. Juneau has served as Chairman of the Board since April 2013, and was appointed as Executive Chairman of the Board effective January 6, 2020. Mr. Juneau is the sole manager of the general partner of Juneau Exploration, L.P. (“JEX”), a company involved in the exploration and production of oil and natural gas. JEX has entered into a number of agreements and arrangements with the Company, which are described under “Certain Relationships and Related Transactions”. Prior to forming JEX, Mr. Juneau served as senior vice president of exploration for Zilkha Energy Company from 1987 to 1998. Prior to joining Zilkha Energy Company, Mr. Juneau served as staff petroleum engineer with Texas International Company for three years, where his principal responsibilities included reservoir engineering, as well as acquisitions and evaluations. Prior to that, he was a production engineer with Enserch Corporation in Oklahoma City. Mr. Juneau previously served as a director of Contango Oil & Gas Company from April 2012 to March 2014. Mr. Juneau is currently a director of Talos Energy and PetroQuest Energy. Mr. Juneau holds a Bachelor of Science degree in Petroleum Engineering from Louisiana State University. Mr. Juneau, as the Company’s co-founder, has substantial history and familiarity with the Company, and significant technical knowledge.

Rick Van Nieuwenhuyse. Mr. Van Nieuwenhuyse was appointed to serve as President, Chief Executive Officer, and director of the Company effective January 6, 2020. He previously served as President and Chief Executive Officer of Trilogy Metals Inc. from January 2012 until December 2019. Between May 1999 and January of 2012, he served as the President and Chief Executive Officer of NOVAGOLD, Inc, a company that he founded. He served as the Vice President of Exploration for Placer Dome from 1990 to 1997. Mr. Van Nieuwenhuyse holds a Candidature degree in Science from Université de Louvain, Belgium and a Master of Science degree in Geology from the University of Arizona. Mr. Van Nieuwenhuyse currently serves on the board of directors of Alexco Resource Corp. He served on the board of directors of Sandfire Resources America, Inc. (formerly, Tintina Resources Inc.) from 2008 until 2016. Mr. Van Nieuwenhuyse has over forty years of experience in the minerals mining industry and brings significant industry and technical knowledge to the Company.

Joseph S. Compofelice. Mr. Compofelice has been a director of the Company since its inception. Since January 2014, Mr. Compofelice has been an operating partner of White Deer Energy, an energy focused private equity fund. Mr. Compofelice is the Chairman since November 2014 and Chief Executive Officer since January 2016 of Stuart Pressure Control, an oilfield services company, controlled by White Deer Energy. Mr. Compofelice is the Chairman and Chief Executive Office of Axios Industrial Group LLC, an industrial service company, controlled by White Deer Energy. Mr. Compofelice has served as Managing Director of Houston Capital Advisors, a boutique financial advisory, mergers and acquisitions investment service since January 2004. Mr. Compofelice also served as Chairman of the Board of Trico Marine Service, a provider of marine support vessels serving the international natural gas and oil industry, from 2004 to 2010 and as its Chief Executive Officer from 2007 to 2010. Mr. Compofelice served as President and Chief Executive Officer of Aquilex Services Corp., a service and equipment provider to the power generation industry, from October 2001 to October 2003. From February 1998 to October 2000 he served as Chairman and Chief Executive Officer of CompX International Inc., a provider of components to the office furniture, computer and transportation industries. From March 1994 to May 1998 he was Chief Financial Officer of NL Industries, a chemical producer, Titanium Metals Corporation, a metal producer and Tremont Corp. Mr. Compofelice received his Bachelor of Science degree at California State University at Los Angeles and his Master of Business Administration at Pepperdine University. Mr. Compofelice has extensive leadership and financial experience.

Joseph G. Greenberg. Mr. Greenberg has been a director of the Company since its inception. He has over thirty years of diversified experience in domestic oil and gas exploration and production. Mr. Greenberg is founder and Chief Executive Officer of Alta Resources, LLC, one of the nation’s largest private producers of natural gas. Mr. Greenberg received a Bachelor of Science degree in Geology and Geophysics from Yale University in 1983, and a Master in Geological Sciences from the University of Texas at Austin in 1986 Mr. Greenberg is a Board member and Chairman Emeritus for YES Prep Public Schools, a system of high performing charter schools serving more than 15,000 low income students in Houston. Mr. Greenberg also serves on the Entrepreneurship Advisory Board for Yale School of Management.

Richard A. Shortz. Mr. Shortz has been a director of the Company since 2016. Mr. Shortz is President and Chief Executive Officer of Pavia Capital, LLP, a family office investment company. Mr. Shortz served as a Partner of Morgan, Lewis & Bockius LLP, an international law firm (“Morgan Lewis”) from 1995 through September 2016 and as a Partner with Jones Day Reavis & Pogue LLP, another international law firm, from 1983 through 1994. He previously was an executive of Tosco Corporation, an independent oil and gas company, from 1973 through 1983 where he became Senior Vice President, General Counsel and Secretary. While a Partner at Morgan Lewis, Mr. Shortz served as Chairman of the firm’s Energy Group and a member of its Board. Mr. Shortz received a Bachelor of Science degree in Accounting from Indiana University in 1967 and a Juris Doctor degree from Harvard Law School in 1970. Mr. Shortz has extensive experience in corporate finance, mergers and acquisitions and corporate governance, regularly advising both public and private energy companies.

All directors and nominees for director of the Company are United States citizens. There are no family relationships between any of our directors or executive officers.

We believe that good corporate governance is important to assure that the Company is managed for the long term benefit of its stockholders. The Board and management of the Company are committed to good business practices, transparency in financial reporting and the highest level of corporate governance and ethics. The Board has specifically reviewed the provisions of the Sarbanes-Oxley Act of 2002, the rules of the Securities and Exchange Commission (“SEC”) and applicable listing standards and rules to maintain its standards of good corporate governance.

The Board has reaffirmed existing policies and initiated actions adopting policies consistent with new rules and listing standards. In particular, we have:

Established an Audit Committee consisting solely of independent directors.

Adopted a formal Audit Committee Charter in September 2010, a copy of which is available on the Company’s website at www.contangoore.com.

Empowered the Audit Committee to engage independent auditors.

Provided the Audit Committee with access to independent auditors and legal counsel.

Adopted a Code of Ethics that satisfies the definition of “code of ethics” under the rules and regulations of the SEC, a copy of which is available on the Company’s website at www.contangoore.com. The Code of Ethics applies to all of the Company’s executives, including its principal executive officer, principal financial officer, and principal accounting officer. If the Company amends or waives the Code of Ethics with respect to the principal executive officer, principal financial officer or principal accounting officer, it will post the amendment or waiver at this location on its website.

Adopted a formal whistleblower protection policy.

Adopted a formal process for stockholders to communicate with the independent directors.

Adopted a formal Nominating Committee Charter in September 2010, a copy of which is available on the Company’s website at www.contangoore.com.

Prohibited personal loans to officers and directors.

Taken appropriate Board and management action to achieve timely compliance with Section 404 of the Sarbanes-Oxley Act of 2002 regarding controls and procedures over financial reporting.

Adopted a formal Compensation Committee Charter in September 2010, a copy of which is available on the Company's website at www.contangoore.com.

Independence. Although the Company is not subject to the New York Stock Exchange (“NYSE”) listing requirements, the Company evaluates the independence of its directors using the NYSE listing standards. After reviewing the qualifications of our current directors and nominees, and any relationships they may have with the Company that might affect their independence, the Board has determined that each director and nominee, other than Mr. Van Nieuwenhuyse and Mr. Juneau, is “independent” as that concept is defined by the listing standards of the NYSE and the applicable rules of the SEC. Mr. Van Nieuwenhuyse and Mr. Juneau are executive officers of the Company and, therefore, the Board has concluded that they are not independent directors.

Corporate Authority & Responsibility. All corporate authority resides in the Board, as the representative of the stockholders. Authority is delegated to management by the Board in order to implement the Company’s mission pursuant to Delaware law and our bylaws. Such delegated authority includes the authorization of spending limits and the authority to hire executives and terminate their services. The independent members of the Board retain responsibility for selection, evaluation and the determination of compensation of the chief executive officer of the Company, oversight of the succession plan, approval of the annual budget, assurance of adequate systems, procedures and controls, and all matters of corporate governance. Members of the Board are kept informed of the Company’s business through discussions with Messrs. Juneau and Van Nieuwenhuyse and with key members of senior management, by reviewing materials provided to them and by participating in Board and committee meetings. Each Board member other than Mr. Van Nieuwenhuyse and Mr. Juneau is independent. Additionally, the Board provides advice and counsel to senior management.

Compensation of Directors. None of the independent directors have received cash compensation since the founding of the Company. During the fiscal year ended June 30, 2020, each outside director of the Company received 30,000 shares of restricted Common Stock that vest in January 2022. There were no other payments for meetings attended or service as chair of a committee. Compensation of directors is determined by Mr. Van Nieuwenhuyse, Mr. Juneau, and the independent directors. Directors who are also executives of the Company do not receive compensation for serving as a director or as a member of a committee of the Board. All directors are reimbursed for reasonable out-of-pocket expenses incurred in connection with serving as a member of the Board.

Director Compensation Table. The following table sets forth the compensation paid by the Company to non-employee directors for the fiscal year ended June 30, 2020:

Stock | Option | All other | |||||||||||||

Fees or paid | Awards | Awards | compensation | ||||||||||||

Name (1) | in cash ($) | ($) (2) | ($) (3) | ($) (4) | Total ($) | ||||||||||

Joseph S. Compofelice | — | 465,306 | — | — | 465,306 | ||||||||||

Joseph G. Greenberg | — | 465,306 | — | — | 465,306 | ||||||||||

Richard A. Shortz | — | 465,306 | — | — | 465,306 | ||||||||||

(1) | Rick Van Nieuwenhuyse, the Company's President and Chief Executive officer, and Brad Juneau, the Company’s Executive Chairman are not included in this table as they are executives of the Company and the compensation they receive as executives of the Company is shown in the Summary Compensation Table. |

(2) | The amounts shown represent expense recognized in the consolidated financial statements contained in the Company’s Annual Report on Form 10-K, as amended, for the fiscal year ended June 30, 2020 (“2020 Consolidated Financial Statements”) related to restricted stock awards granted to non-executive directors, excluding any assumptions for future forfeitures. There were no actual forfeitures of non-executive director restricted stock awards in fiscal year 2020. These restricted stock awards were granted in November 2016, November 2017, November 2018, December 2018, and November 2019. Of the restricted stock awards granted in November 2016, all of the shares will vest in January 2021. Of the restricted stock awards granted in November 2017, all of the shares vested in January 2020. Of the restricted stock awards granted in November 2018 and December 2018, all of the shares will vest in January 2021. Of the restricted stock granted in November 2019, all of the shares will vest January 2022. |

(3) | No option awards were granted to non-executive directors during fiscal years 2018, 2019 or 2020. |

| (4) | The Company did not pay a cash stipend, have non-equity incentive plan compensation, have any type of deferred compensation program, or pay any other form of compensation to its directors in fiscal year 2020. |

Board Size. We believe smaller to mid-size boards are more cohesive, work better together and tend to be more effective monitors than larger boards. Our Bylaws currently provide for at least three and not more than seven directors.

Annual Election of Directors. In order to create greater alignment between the Board’s and our stockholders’ interests and to promote greater accountability to the stockholders, directors are elected annually.

Meetings. Our Board has meetings, as necessary. During the fiscal year ended June 30, 2020, the Board held eighteen meetings. During the fiscal year ended June 30, 2020, the Board passed resolutions by unanimous written consent on two occasions. All of our Board members attended 100% of all Board and applicable committee meetings and the Company’s 2019 annual meeting. We encourage our Board to attend our annual meeting of stockholders.

Committee Structure. It is the general policy of the Company that the Board as a whole will consider all major decisions. The committee structure of the Board includes the Audit Committee, the Compensation Committee, and the Nominating Committee. The Board may form other committees as it determines appropriate. A copy of the charter for each committee is available to any stockholder who requests a copy by delivering written notice to Contango ORE, Inc., 3700 Buffalo Speedway, Suite 925, Houston, Texas 77098. The charter for each committee is also available on our website at www.contangoore.com.

Audit Committee. The Audit Committee was established by the Board for the purpose of overseeing the accounting and financial reporting processes of the Company and audits of the financial statements of the Company. The Audit Committee recommends the appointment of independent public accountants to conduct audits of our financial statements, reviews with the accountants our quarterly and annual financial statements and the plan and results of the auditing engagement, approves other professional services provided by the accountants and evaluates the independence of the accountants. The Audit Committee also reviews the scope and adequacy of our system of internal controls and procedures over financial reporting and oversees compliance with our Code of Ethics. Members of the Audit Committee are Messrs. Compofelice (Committee Chairman), Greenberg, and Shortz. Each member of the Audit Committee is independent, as independence for audit committee members is defined in the listing standards of the NYSE and the applicable rules of the SEC. The Audit Committee met formally four times during the fiscal year ended June 30, 2020. The Board has determined that Mr. Compofelice is an “audit committee financial expert” as defined by the rules of the SEC.

Compensation Committee. The Compensation Committee was created by the Board for the purpose of administering the Contango ORE, Inc. 2010 Equity Compensation Plan and the compensation for the Chief Executive Officer. Additionally, the Compensation Committee determines which executive officers and other executives may receive stock options, stock units, restricted stock awards, stock appreciation rights and other stock based awards and the amounts of such stock based awards. Members of the Compensation Committee are Messrs. Shortz (Committee Chairman), Compofelice, and Greenberg. Each member of the Compensation Committee is an “independent director” as defined in the applicable listing standards of the NYSE and in the applicable rules of the SEC. For a description of the Compensation Committee’s processes and procedures, see the section entitled “Compensation Discussion and Analysis” below. The Compensation Committee met formally four times during the fiscal year ended June 30, 2020.

Nominating Committee. The Nominating Committee was created by the Board for the purpose of overseeing the identification, evaluation and selection of qualified candidates for appointment or election to the Board. The Nominating Committee identifies individuals qualified to become Board members and recommends to the Board nominees for election as directors of the Company, taking into account that the Board as a whole shall have competency in industry knowledge, accounting and finance, and business judgment. While the Company does not have a formal diversity policy, the Nominating Committee seeks members from diverse backgrounds so that the Board consists of members with a broad spectrum of experience and expertise and with a reputation for integrity. Directors should have experience in positions with a high degree of responsibility, be leaders in the companies or institutions with which they are affiliated, and be selected based upon contributions that they can make to the Company. The Nominating Committee shall give the same consideration to candidates for director nominees recommended by Company stockholders as those candidates recommended by others. Members of the Nominating Committee are Messrs. Greenberg (Committee Chairman), Compofelice, and Shortz. Each member of the Nominating Committee is independent as independence for nominating committee members is defined in the applicable listing standards of the NYSE and the applicable rules of the SEC. The Nominating Committee met formally once during the fiscal year ended June 30, 2020.

Board Leadership Structure. The Board has the responsibility for selecting the appropriate leadership structure for the Company. Following the appointment of Rick Van Nieuwenhuyse as the President and Chief Executive Officer of the Company, effective January 6, 2020 the Board appointed Mr. Juneau to serve as Executive Chairman of the Board. The Board believes that the separation of the Executive Chairman and the Chief Executive Officer functions in this structure is appropriate for oversight purposes on behalf of its investors, because it clarifies the individual roles of the Executive Chairman and Chief Executive Officer and enhances accountability. In addition, the Board believes that this structure is appropriate for the Company because Mr. Juneau is a co-founder of the Company and, through JEX, initially acquired the property leased from the Village of Tetlin, which is the primary asset of Peak Gold, LLC (the “Joint Venture Company”), which in turn is the primary asset of the Company. In addition, Mr. Juneau has unique experience to lead the Board, having served as President and Chief Executive Officer of the Company.

Risk Oversight. We administer our risk oversight function through our Audit Committee and our Compensation Committee as well as through our Board as a whole. Our Audit Committee is empowered to appoint and oversee our independent registered public accounting firm, monitor the integrity of our financial reporting processes and systems of internal controls and provide an avenue of communication among our independent auditors, management, our internal auditing department and our Board. Our Compensation Committee is responsible for overseeing the management of risks related to our compensation arrangements.

More information about the Company’s corporate governance practices and procedures is available on the Company’s website at www.contangoore.com.

Required Vote

The affirmative vote of holders of a plurality of the votes cast at the Annual Meeting is required for the election of each director. Brokers do not have discretion to vote on this proposal without your instruction. If you do not instruct your broker how to vote on this proposal, your broker will deliver a broker non-vote on this proposal. Abstentions and broker non-votes will not have any effect on the outcome of this proposal.

THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE FIVE NOMINEES AS A DIRECTOR OF THE COMPANY, TO SERVE UNTIL THE NEXT ANNUAL MEETING OF STOCKHOLDERS OR UNTIL HIS OR HER SUCCESSOR IS DULY ELECTED AND QUALIFIED.

PROPOSAL 2

RATIFICATION OF THE SELECTION OF OUR AUDITORS

The Board has appointed Moss Adams LLP (“Moss Adams”), independent public accountants, for the examination of the accounts and audit of our financial statements for the fiscal year ending June 30, 2021. At the Annual Meeting, the Board will present a proposal to the stockholders to approve and ratify the engagement of Moss Adams. The Board expects that representatives of Moss Adams will be present and will have the opportunity to make a statement, if they desire, and to respond to appropriate questions. The Audit Committee will consider the failure to ratify its selection of Moss Adams as independent public accountants as a direction to select other auditors for the fiscal year ending June 30, 2022.

During the Company’s two most recent fiscal years ended June 30, 2020 and 2019, and through the date hereof, there were (i) no disagreements with Moss Adams on any matter of GAAP or practices, financial statement disclosures, or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of Moss Adams would have caused Moss Adams to make reference to the subject matter of the disagreements in connection with its reports, and (ii) no events of the type listed in paragraphs (A) through (D) of Item 304(a)(1)(v) of Regulation S-K.

During the Company’s two most recent fiscal years ended June 30, 2020 and 2019, and through the date hereof, neither the Company, nor anyone on its behalf, has consulted Moss Adams with respect to (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and neither a written report was provided to the Company nor oral advice was provided to the Company that Moss Adams concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) or a reportable event (as described in Item 304(a)(1)(v) of Regulation S-K).

Fees

Aggregate fees for professional services rendered to us by Moss Adams, the Company’s independent public accountants, for the fiscal years ended June 30, 2020 and 2019, were:

Year Ended June 30, | ||||||||

Category of Service | 2020 | 2019 | ||||||

Audit Fees - Moss Adams | $ | 75,075 | $ | 70,785 | ||||

Audit-Related Fees | — | — | ||||||

Tax Fees | — | — | ||||||

All Other Fees | — | — | ||||||

| $ | 75,075 | $ | 70,785 | |||||

The Audit Fees for the years ended June 30, 2020 and 2019 were for professional services rendered in connection with the audit of the Company’s consolidated financial statements for the years ended June 30, 2020 and 2019, issuance of consents, quarterly reviews and assistance with and review of documents filed with the SEC.

There are no other fees for services rendered to us by Moss Adams. Moss Adams did not provide to us any financial information systems design or implementation services during fiscal years ended June 30, 2020 or June 30, 2019.

Audit Committee Pre-Approval Policies and Procedures

All of the 2020 audit services provided by Moss Adams were approved by the Audit Committee.

The Audit Committee has established pre-approval policies and procedures related to the provision of audit and non-audit services. Under these procedures, the Audit Committee selects and appoints outside auditors, considers the independence and effectiveness of the outside auditors, approves the fees and other compensation to be paid to the outside auditors and is responsible for oversight of the outside auditors and reviews any revisions to the estimates of audit and non-audit fees initially approved. The Audit Committee’s procedures prohibit the independent auditor from providing any non-audit services unless the service is permitted under applicable law and is pre-approved by the Audit Committee. The Audit Committee receives the written disclosures required by generally accepted auditing standards. The Audit Committee annually requires the outside auditors to provide the Audit Committee with a written statement delineating all relationships between the outside auditors and the Company. The Audit Committee actively engages in a dialogue with the outside auditors with respect to any disclosed relationships or services that may impact the objectivity and independence of the outside auditors. The Audit Committee recommends that the Board of Directors take appropriate action in response to the outside auditors’ report to satisfy itself of the outside auditors’ independence. The scope of services and fees are required to be compatible with the maintenance of the accounting firm’s independence, including compliance with SEC rules and regulations.

Required Vote

The affirmative vote of holders of a majority of the shares of our Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote is required to approve this proposal. Brokers have discretion to vote on this proposal without your instruction. If you do not instruct your broker how to vote on this proposal, your broker will be permitted to vote your shares in its discretion on this proposal. As a result, we do not expect any broker non-votes in connection with this proposal. Abstentions will have the same practical effect as a vote against this proposal.

THE BOARD RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE

SELECTION OF MOSS ADAMS LLP AS INDEPENDENT PUBLIC ACCOUNTANTS.

APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

On October 9, 2020, the Board approved and declared advisable an amendment to Article IV of our Certificate of Incorporation (the “Certificate of Incorporation”) to increase the number of authorized shares of Common Stock from 30,000,000 to 45,000,000 shares. The amendment would not change the number of authorized shares of preferred stock or the par value per share of any stock. The text of the proposed amendment is set forth below, and included in Appendix A.

Purpose and Effects of the Proposed Amendment

We are currently authorized pursuant to our Certificate of Incorporation to issue up to 30,000,000 shares of Common Stock. As of October 9,November 6, 2020, there were 5,994,667 shares of Common Stock issued and outstanding, resulting in 24,005,333 shares of authorized and unissued shares of Common Stock available for issuance. The purpose of our proposed increase in the authorized shares of Common Stock is to provide our Board with flexibility to accomplish a range of corporate purposes, including financings, corporate mergers and acquisitions, issuances under equity compensation plans, and other general corporate uses. If the authorization of an increase in the available capital stock is not approved, there may be delay and expense related to the need to obtain future approval of stockholders to increase authorized shares and this delay could impair our ability to address our corporate needs.

We have no immediate plans to issue any capital stock in financings, corporate mergers and acquisitions, or other corporate transactions. In the ordinary course of business, we issue Common Stock under our Equity Plan and under our Short Term Incentive Plan to officers, directors, and employees.

Potential Adverse Effects

Stockholders do not have preemptive rights and thus stockholders would not have any preferential rights to purchase new shares when issued.

The increase in authorized shares will not affect the rights of current stockholders, but future issuances of Common Stock may have a dilutive effect on the Company’s earnings per share and book value per share and will have a dilutive effect on the voting power of current stockholders.

In addition, the availability of additional shares of Common Stock for issuance could, under certain circumstances, discourage or make more difficult any efforts to obtain control of the Company. The Board is not aware of any attempt, or contemplated attempt, to acquire control of the Company, nor is this proposal being presented with the intent that it be used to prevent or discourage any acquisition attempt. However, nothing would prevent the Board from taking any such actions that it deems to be consistent with its fiduciary duties.

Text of the Amendment

We propose to amend the second sentence of Article IV of the Certificate of Incorporation to read in its entirety as follows:

“The number of shares of Common Stock authorized to be issued is forty-five million (45,000,000), par value $0.01 per share, and the number of shares of Preferred Stock authorized to be issued is fifteen million (15,000,000), par value $0.01 per share; the total number of shares of stock which the Corporation is authorized to issue is sixty million (60,000,000).”

As a result, the only changes that would be made to Article IV of the Certificate of Incorporation, as currently in effect, would be to increase the number of authorized shares of Common Stock from 30,000,000 to 45,000,000 and to reflect a corresponding increase in the aggregate number of shares of capital stock of all classes that may be issued from 45,000,000 to 60,000,000. The full text of the proposed amendment to the Certificate of Incorporation to effect Proposal 3 is included in Appendix A to this Proxy Statement.

Effectiveness of the Amendment

If Proposal 3 is approved and adopted by the requisite vote, the proposed amendment to Article IV of the Certificate of Incorporation will become effective upon the filing of a Certificate of Amendment to the Certificate of Incorporation setting forth the proposed amendment with the Delaware Secretary of State.

Required Vote

The affirmative vote of holders of a majority of the shares of our Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote is required to approve this proposal. Brokers have discretion to vote on this proposal without your instruction. If you do not instruct your broker how to vote on this proposal, your broker will be permitted to vote your shares in its discretion on this proposal. As a result, we do not expect any broker non-votes in connection with this proposal. Abstentions will have the same practical effect as a vote against this proposal.

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR”

THE APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK.

ADVISORY VOTE ON EXECUTIVE COMPENSATION

Introduction

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) requires that we provide our stockholders with the opportunity to vote to approve, on a non-binding, advisory basis, the compensation of our named executive officers, as disclosed in this Proxy Statement and to express their views on such compensation. We welcome the opportunity to give our stockholders an opportunity to vote on executive compensation at the Annual Meeting. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the named executive officers and our philosophy, policies and practices as described in this Proxy Statement. We currently conduct annual advisory votes on executive compensation, and we expect to conduct the next advisory vote on executive compensation at our 2020 Annual Meeting of Stockholders.

We recognize that executive compensation is an important matter for our stockholders. Stockholders are encouraged to read the “Executive Compensation” section of this Proxy Statement, which discusses in detail how our compensation policies and procedures implement our compensation philosophy.

Text of the Resolution to be Adopted

As a matter of good corporate governance and in accordance with Section 14A of the Securities Exchange Act of 1934, the Board is asking stockholders to vote “FOR” the following resolution:

“RESOLVED, that the stockholders of Contango ORE, Inc. (the “Company”) approve, on a non-binding, advisory basis, the compensation of the named executive officers, as disclosed in the Executive Compensation section, the 2020 Summary Compensation Table and the other related tables and disclosure in the Company’s Proxy Statement for the 2020 Annual Meeting of the Stockholders of the Company.”

As an advisory vote, this proposal is not binding on the Board or the Compensation Committee. Although the vote is non-binding, the Board and the Compensation Committee value the opinions of our stockholders, and will carefully consider the outcome of the vote in its ongoing evaluation of the Company’s executive compensation program and when making future compensation decisions for executive officers. In particular, to the extent there is any significant vote against the compensation of our named executive officers as disclosed in this Proxy Statement, we will consider our stockholders’ concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns.

Required Vote

The affirmative vote of holders of a majority of the shares of our Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote is required to approve this proposal. Brokers do not have discretion to vote on this proposal without your instruction. If you do not instruct your broker how to vote on this proposal, your broker will deliver a broker non-vote on this proposal. Broker non-votes will not have any effect on the outcome of this proposal. Abstentions will have the same practical effect as a vote against this proposal.

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR”

THE APPROVAL, ON A NON-BINDING, ADVISORY BASIS, OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS.

ADVISORY VOTE ON THE FREQUENCY OF THE ADVISORY VOTE ON THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

The Company is seeking a vote, on a non-binding, advisory basis, regarding the frequency of the advisory vote on the compensation of the Company’s named executive officers as disclosed pursuant to the executive compensation disclosure rules of the SEC. By voting on this proposal, stockholders may indicate whether they would prefer that we conduct future advisory votes on executive compensation once every one (annually), two or three years. Stockholders also may, if they wish, abstain from casting a vote on this proposal.

At our 2013 Annual Meeting of Stockholders, our stockholders voted for an annual advisory vote on executive compensation. We have held an advisory vote on executive compensation for each of the past six years accordingly. In light of this result and other factors, our Board has determined that an annual advisory vote on executive compensation will allow our stockholders to provide timely, direct input on our executive compensation philosophy, policies and practices as disclosed in our proxy statement each year. Our Board believes that an annual vote is therefore consistent with our efforts to engage in an ongoing dialogue with our stockholders on corporate governance matters and our executive compensation philosophy, policies, and practices.

We recognize that our stockholders may have different views as to the best approach and we look forward to hearing from them as to their preference on the frequency of an advisory vote on executive compensation.

This vote is advisory, which means that it is not binding on the Company, our Board or the Compensation Committee. However, our Board and the Compensation Committee value the opinions of our stockholders and will take into account the outcome of the vote when considering the frequency of future advisory votes on executive compensation. Our Board may decide that it is in the best interest of our stockholders and the Company to hold an advisory vote on executive compensation on a different frequency than the frequency receiving the most votes cast by our stockholders.

Our next advisory vote on the frequency of the advisory vote on executive compensation will occur at our 2026 Annual Meeting of Stockholders.

Required Vote

The choice – one year, two years, or three years – that receives the greatest number of the votes cast at the Annual Meeting will reflect our stockholders’ preference regarding frequency of a stockholder advisory vote on executive compensation. Brokers do not have discretion to vote on this proposal without your instruction. If you do not instruct your broker how to vote on this proposal, your broker will deliver a broker non-vote on this proposal. Abstentions and broker non-votes will not have any effect on the outcome of this proposal.

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR AN ANNUAL, “ONE YEAR,” ADVISORY VOTE ON THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS.

APPROVAL TO GRANT DISCRETIONARY AUTHORITY

TO CHAIRMAN OF THE ANNUAL MEETING TO ADJOURN THE ANNUAL

MEETING IF NECESSARY TO SOLICIT ADDITIONAL PROXIES

Although it is not expected, the Annual Meeting may be adjourned for the purpose of soliciting additional proxies. Any such adjournment of the Annual Meeting may be made without notice, other than by the announcement made at the Annual Meeting, by approval of the affirmative vote of the holders of a majority of shares entitled to vote on this proposal at the Annual Meeting, present in person or represented by proxy and entitled to vote at the meeting, whether or not a quorum exists. We are soliciting proxies to grant discretionary authority to the chairman of the Annual Meeting to adjourn the Annual Meeting, if necessary, for the purpose of soliciting additional proxies in favor of any of the Proposals 1 through 5. Upon approval of this proposal, the chairperson will have the discretion to decide whether or not to use the authority granted to such person pursuant to this Proposal 6 to adjourn the Annual Meeting. Any adjournment of the Annual Meeting for the purpose of soliciting additional proxies will allow our stockholders who have already sent in their proxies to revoke them at any time prior to their use at the Annual Meeting as adjourned or postponed.

Required Vote

The affirmative vote of holders of a majority of shares entitled to vote on this proposal at the Annual Meeting present in person or represented by proxy at the meeting and entitled to vote is required to approve this proposal. Brokers have discretion to vote on this proposal without your instruction. If you do not instruct your broker how to vote on this proposal, your broker will be permitted to vote your shares in its discretion on this proposal. As a result, we do not expect any broker non-votes in connection with this proposal. Abstentions will have the same practical effect as a vote against this proposal.

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR”

THE APPROVAL TO GRANT DISCRETIONARY AUTHORITY

TO CHAIRMAN OF THE ANNUAL MEETING TO ADJOURN THE ANNUAL

MEETING IF NECESSARY TO SOLICIT ADDITIONAL PROXIES.

Executive Officers

The following sets forth the names, ages and positions of our executive officers together with certain biographical information as of the date of this filing:

Name | Age | Position |

Brad Juneau | 60 | Executive Chairman and Director |

| Rick Van Nieuwenhuyse | 64 | President, Chief Executive Officer, and Director |

Leah Gaines | 44 | Vice President, Chief Financial Officer, Chief Accounting Officer, Treasurer and Secretary |

Brad Juneau. For biographical information, see “Proposal 1 - Election of Directors - Nominees.”

Rick Van Nieuwenhuyse. For biographical information, see “Proposal 1 - Election of Directors - Nominees.”

Leah Gaines. Ms. Gaines was appointed as the Company’s Vice President, Chief Financial Officer, Chief Accounting Officer, Treasurer and Secretary on October 1, 2013. Ms. Gaines has also served as Vice President and Chief Financial Officer of JEX since October 2010. Prior to joining JEX, she served as the Controller for Beryl Oil and Gas, LP and Beryl Resources LP from July 2007 to December 2009. From April 2006 to July 2007, Ms. Gaines held the position of Financial Reporting Manager at SPN Resources, a division of Superior Energy Services. From 2003 to 2006, Ms. Gaines worked as a Senior Financial Reporting Accountant at Hilcorp Energy Company. Ms. Gaines was a Principal Accountant at El Paso Corporation in its Power Asset division from 2001 to 2003. Prior to that, Ms. Gaines worked at Deloitte and Touche, LLP for three years as a Senior Auditor. Ms. Gaines graduated Magna Cum Laude from Angelo State University with a Bachelor of Business Administration in Accounting and is a Certified Public Accountant with over twenty years of experience.

Our executive officers are elected annually by the Board and serve until their successors are duly elected and qualified or until their earlier resignation or removal. All executive officers of the Company are United States citizens. There are no family relationships between any of our directors or executive officers.

Compensation Discussion and Analysis

This section of the Proxy Statement describes and analyzes our executive compensation philosophy and program in the context of the compensation paid during the last fiscal year to our named part-time executive officers.

Overview of 2020 fiscal year Performance and Compensation. We are engaged in the exploration in the State of Alaska for gold ore and associated minerals. Following the establishment of our Joint Venture Company with an affiliate of Royal Gold, Inc. (“Royal Gold”) in January 2015, the Joint Venture Company continued the drilling program initiated by the Company at the Tetlin gold project in Alaska. The Joint Venture Company has expended approximately $47.1 million through June 30, 2020 in connection with the Tetlin gold project to delineate and expand upon the original Peak zone discovery by the Company. The work program has included expansion of the Peak zone and the discovery and expansion of the North Peak zone and several other gold, silver, and copper prospects. Through June 30, 2020, Royal Gold had contributed $37.0 million to the Joint Venture Company and earned a 40.0% economic interest in the Joint Venture Company. On September 30, 2020, in a series of related transactions, Kinross Gold Corporation, a corporation formed under the laws of Ontario, Canada (“Kinross”), through its wholly owned subsidiary, acquired all of the interest in the Joint Venture Company held by Royal Gold, and an additional 30% of the membership interest in the Joint Venture Company held by the Company. The Company, through its wholly owned subsidiary, currently holds a 30% interest in the Joint Venture Company, with Kinross holding a 70% interest in the Joint Venture Company and serving as the manager and operator of the Joint Venture Company.

Philosophy. The Company is an exploration stage organization without any source of revenue. The Company has one full-time employee, Rick Van Nieuwenhuyse, its President and Chief Executive Officer who is responsible for the management of the Company. The Company currently has three part-time executives who are employees of JEX. The Company has not historically paid cash salaries or other benefits to these part-time executives. The Audit Committee, the Compensation Committee and the Board in October 2016 adopted and approved a new management and compensation system effective October 1, 2016. The Company entered into a Management Services Agreement with JEX, which is owned by Brad Juneau and his affiliates. On November 20, 2019, the Company entered into an Amended and Restated Management Services Agreement (the “A&R MSA”), with JEX, which amends and restates the Management Services Agreement between the Company and JEX dated as of October 1, 2016. Pursuant to the A&R MSA, JEX will continue, subject to the direction of the Board of Directors, to manage the general and administrative affairs of the Company and its interest in Joint Venture Company. The services provided to the Company by JEX include corporate finance, accounting, budget, reporting, risk management, operations and stockholder relation functions of the Company. Pursuant to the A&R MSA, the Company will pay to JEX a monthly fee of $47,000, which includes an allocation of approximately $6,900 for office space and equipment. JEX will also be reimbursed for its reasonable and necessary costs and expenses of third parties incurred for the Company. No part of the fee payable to JEX pursuant to the A&R MSA is allocated for compensation of our Executive Chairman, Brad Juneau, who is compensated separately as determined by the independent directors of the Company. In addition, executives of JEX may be granted restricted stock, stock options or other forms of compensation by the independent directors of the Company. The amount of time and expertise required to effectively manage and administer the business and affairs of the Company will continue to be monitored by the board of directors of the Company for necessary adjustments or modifications depending upon the amount of time required to be spent on the business and affairs of the Company by the executives and the progress of the Joint Venture Company in its exploratory programs in Alaska.

Objectives. We compete with a variety of companies and organizations to hire and retain individual talent. As a result, the primary goal of our compensation program is to help us attract, motivate and retain the best people possible. We implement this philosophy by:

encouraging, recognizing and rewarding outstanding performance;

recognizing and rewarding individuals for their experience, expertise, level of responsibility, leadership, individual accomplishment and other contributions to us; and

recognizing and rewarding individuals for work that helps increase our value.

We use executive compensation to align our executive officers’ goals with our mission, business strategy, values and culture.

Market Compensation Data. The Company has selected a list of four peer companies (the “Peer Group”), all of which are very small companies in the mining industry. These companies share relevant business risk and financial factors such as revenue, market capital, net income, and total assets. Companies similar in size but in unrelated industries are not included because the Company typically does not hire executives from such companies, nor would the Company be likely to lose executives to such companies:

Orla Mining Ltd.

Corvus Gold

| • | Pilot Gold Inc. | |

| • | Midas Gold Corp. | |

| • | NovaGold, Inc. | |

| • | Battle North Gold Corp. | |

| • | Trilogy Metals, Inc. | |

| • | Almaden Minerals | |

| • | Bluestone Resources, Inc. | |

• | Sabina Gold & Silver Corp. |

Components of Senior Executive Compensation. Historically, the primary element of annual compensation for executives of the Company has been the granting of equity awards in the form of restricted stock and stock options. Effective January 6, 2020, Rick Van Nieuwenhuyse was appointed to serve as the Company’s President and Chief Executive Officer, with an initial base salary of $350,000 per year. The Company has three part-time executives and has not historically paid cash salaries or other benefits to such part-time executives. Compensation for each executive is designed to align the executive’s incentives with the long-term interests of the Company’s stockholders. The Company predominantly grants equity awards to create incentives for future performance. Executives receive equity awards to align their interests with our stockholders’ interests and for working toward the long-term success of the Company.